Condo Insurance in and around San Antonio

Unlock great condo insurance in San Antonio

Cover your home, wisely

Home Is Where Your Heart Is

As with any home, it's a good plan to make sure you have coverage for your condominium. State Farm's Condo Unitowners Insurance has excellent coverage options to fit your needs.

Unlock great condo insurance in San Antonio

Cover your home, wisely

Condo Unitowners Insurance You Can Count On

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has dependable options to keep your most personal possessions protected. You’ll get coverage options to correspond with your specific needs. Thankfully you won’t have to figure that out by yourself. With personal attention and remarkable customer service, Agent Joel Ponton can walk you through every step to help develop a policy that shields your condo unit and everything you’ve invested in.

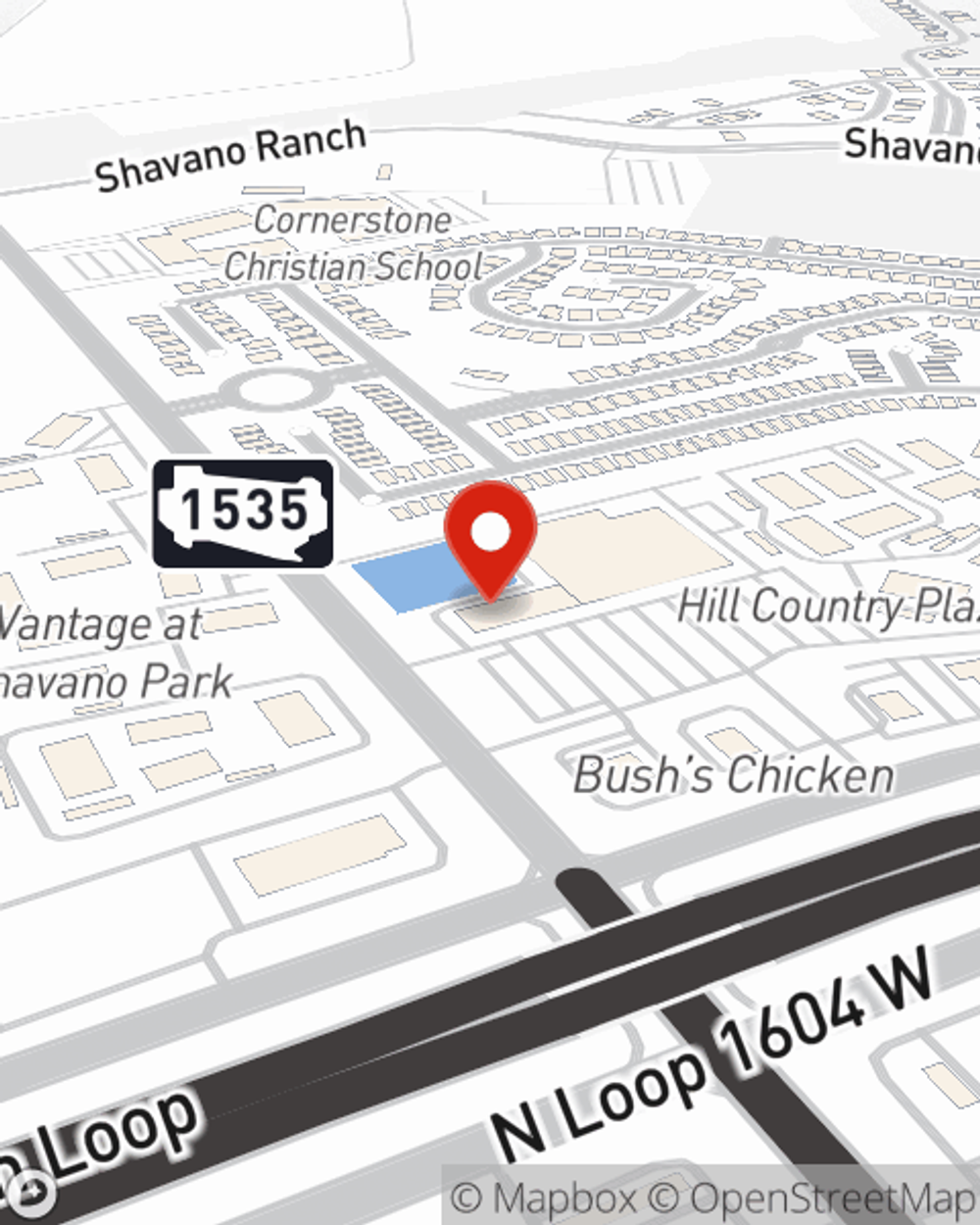

Getting started on an insurance policy for your unit is just a quote away. Get in touch with State Farm agent Joel Ponton's office to check out your options.

Have More Questions About Condo Unitowners Insurance?

Call Joel at (210) 349-1144 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Joel Ponton

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.